SolGold shares dive despite raising $36m with Jiangxi backing

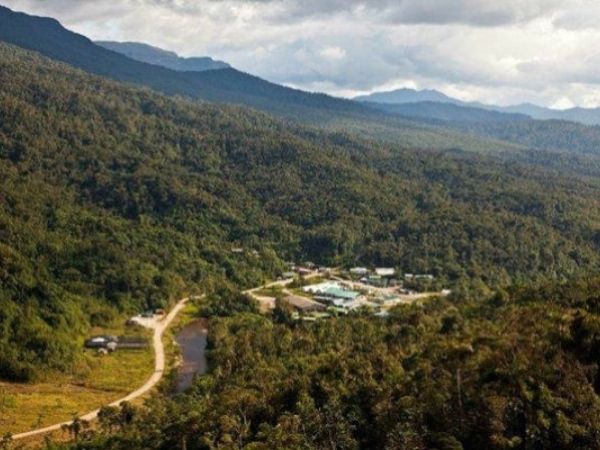

photo: The Cascabel copper-gold project in Ecuador. (Image courtesy of SolGold.)

Cecilia Jamasmie

News Australia NZ South Pacific Copper Gold

Shares in Ecuador-focused SolGold (LON, TSX: SOLG) dropped on Monday more than 7% after revealing it had completed a $36 million capital raise with the participation of new investors, including Jiangxi Copper.

The company, which saw its chief executive and managing director of less than a year leave last month, is said to be at the centre of a bidding war between Jiangxi, China’s largest copper miner on the one side, and BHP (ASX: BHP) — possibly in alliance with Newcrest Mining (ASX: NCM) — on the other.

According to sources who asked to remain unnamed, the decision to let CEO Darryl Cuzzubbo go and the delay of both the Cascabel definitive feasibility study and the Porvenir preliminary economic assessment, had the goal of making the company more appealing to bidders by simplifying the management structure.

BHP and Newcrest, already SolGold’s largest shareholders, recently saw their stakes in the company diluted to about 13.5% each after it announced in October deal to simplify the ownership structure of Cascabel through a friendly tie-up with co-owner Cornerstone Capital Partners.

A few weeks later, SolGold inked a funding deal with Osisko Gold Royalties (TSX, NYSE: OR) in which it obtained $50 million from Osisko in return for 0.6% net smelter return royalty.

The two Australian giants criticized the agreement, calling it “negative” as they believe it came at a “disappointing high-cost” for all SolGold stakeholders.

Both miners were once again rattled in late November, when SolGold announced the share raise that brought Jiangxi on board.

The Chinese miner now has a 6.3% interest in the company, which is developing the giant Cascabel copper-gold project in the Imbabura province of northwest Ecuador.

Among largest copper mines

Cascabel is considered one of Ecuador’s most ambitious mining projects, as the country is keen to develop its vast mineral resources and spur its sluggish economy.

According to the pre-feasibility study published in April, annual production will average 132,000 tonnes of copper, 358,000 ounces of gold and 1 million ounces of silver during Cascabel’s 55-year life-of-mine.

This means the asset has the potential to become one of the 20 largest copper-gold mines in South America.

Alpala, the largest deposit found at Cascabel so far, has measured and indicated resources of 2.7 billion tonnes grading 0.53% copper-equivalent (0.37% copper, 0.25 grams gold per tonne, and 1.08 parts per million silver) for 9.9 million tonnes of contained copper, 21.7 million oz. gold and 92.2 million oz. of silver.

Source: SoldGold’s presentation Nov. 2021.

During the first 25 years of mining, Cascabel is expected to have an average annual production of 207,000 tonnes of copper, 438,000 ounces of gold and 1.4 million ounces of silver.

Over the last two years, Ecuador has attracted a flurry of interest from big miners looking to increase their exposure to copper. The highly conductive metal is in demand for use in renewable energy and electric vehicles, but big, new deposits are rare.

It is estimated that the global copper industry needs to spend more than $100 billion to build mines able to close what could be an annual supply deficit of 4.7 million tonnes by 2030.

SolGold lost 1.29p in London on Monday, closing 7% lower at 17.09p per share, which leaves the miner with a market capitalization of about £392 million ($480m).

12 diciembre 2022

Fuente: Mining com (https://bit.ly/3FQLeqw)

Más Noticias

Más curiosidades

Mingaservice ofrece a sus clientes soluciones ingeniosas, eficientes y efectivas para las industrias: minera, geológica, petrolera, ambiental y social.

Somos una empresa con valores de responsabilidad socio-ambiental frente a nuestros clientes y sus colaboradores directos e indirectos.